In mid 2015 a group of executives were huddled in a windowless Mumbai conference room debating how to overcome what many believed to be an insurmountable challenge. Half the room were bankers, the rest were an eclectic mix of entrepreneurs, transformation specialists and designers. The bankers were adamant that the task in hand was not possible – the regulations were too onerous and the infrastructure too immature. The non bankers, unencumbered by careers of interactions with banking regulators, were sure that it could be done. The task? To launch the first fully digital bank in India. A bank where customers could open an account without visiting a branch. A bank that could be run with 10% of the staffing levels of a conventional bank. A bank that was not just a fancy front end app supported by armies of humans, but fully digital from end to end. The team needed a new approach if they wanted to move forward. What unfolded in that room changed the course of the project.

The team tried a workshopping technique called “back-casting” that involved designing the implementation from the future back rather than from the present forward. The team described precisely the new bank’s future customer experience and operation model and then defined the bold steps that needed to be taken to get there. The technique had been designed specifically to help teams overcome big challenges. Coming out of the exercise were three stand-out principles that proved to be pivotal.

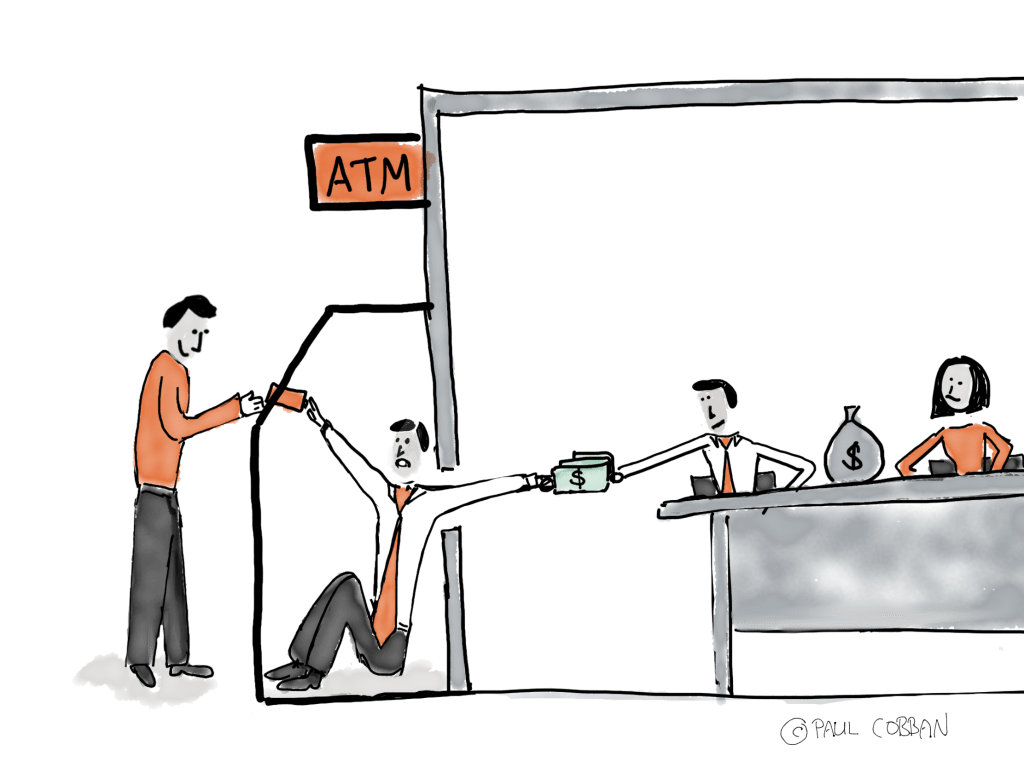

It was clear to the team that the new bank needed to be digital to the core. They could not simply apply “digital lipstick”. In order to scale, all processes needed to be digitally automated. There could be no manual hand offs to the operations teams. There could be no residual manual steps for the back office planned to be fixed later and then forgotten. In addition the customer journey had to been frictionless but could not rely on a branch network. This meant working with technology partners who could provide solutions in three areas – natural language processing AI for a sophisticated chat bot, security software to allow digital onboarding and a financial management capability. To take advantage of the AADHAR biometric verification system that had recently been implemented by the forward-thinking Indian government, the team decided to partner with an Indian coffee shop chain where customers could use thumb scanners to verify their identity and also get a free cup of coffee.

Like product companies that “design for manufacturer”, the bank recognised the need for products and journeys to be designed with operations in mind . To optimise for productivity and risk the operations teams were included in the design stage to ensure products were “designed for operations”. For the new bank this approach was not going to be good enough. The bank needed to be run with a staffing level a small fraction of that of a traditional bank. The team realised they needed to design for no operations. Processes had to be straight-through. Products had to be standard and simplified to eliminate the exceptions that drive manual processing.

Similarly the new bank needed a customer support model that not just reacted to customer problems but predicted and prevented them. Best in class customer service units focus on dealing in with customer queries completely at the time of contact and “first call resolution” is recognised as the metric that drives customer satisfaction. However the team realised that they needed to create a level of reliability and ease of use where customers did not need to call at all. The team introduced the concept of zero call resolution – involving frictionless customer journeys and the use of AI to predict problems before they occurred. The team set themselves a challenge of preventing 1 million customer problems before they occurred.

Breaking the larger problem down in these concepts energised the teams. More traditional problem solving techniques could then be employed. Not only were the concepts the foundation of the new bank in India which was launched less than a year later but also were retrofitted into the existing digital offerings in the more developed markets.

Leadership Lessons

Starting with the end in mind and defining the key steps together helps to overcome seemingly impossible barriers.

Eclectic teams are more likely to have the belief and creativity to drive ambitious innovation.

Breakthrough solutions can be usually be applied beyond the current solution.

If you enjoyed this post feel free to subscribe and you can receive the next post direct to your inbox