What happens in your company when IT systems fail, software development projects are late or there is a data breach? Do the business people indignantly escalate the issues to the IT department? Do they write angry emails to the CIO? If that is the case and you aspire to be a digital company then you have a problem. Such friction between business and tech teams is indicative of a company that does not realise what it means to be digital and is a huge obstacle to transformation. Digital companies do not differentiate between business and technology. Leaders of digital companies are ambidextrous – they know how to prioritise between investment in system performance and revenue generating features. They know that they are accountable for keeping for system stability, security, customer experience as well as meeting financial targets. Unfortunately ambidextrous talent does not typically exist in legacy companies where organisational structures and processes tend to reinforce the tech and business silos. However It is possible to bridge the chasm.

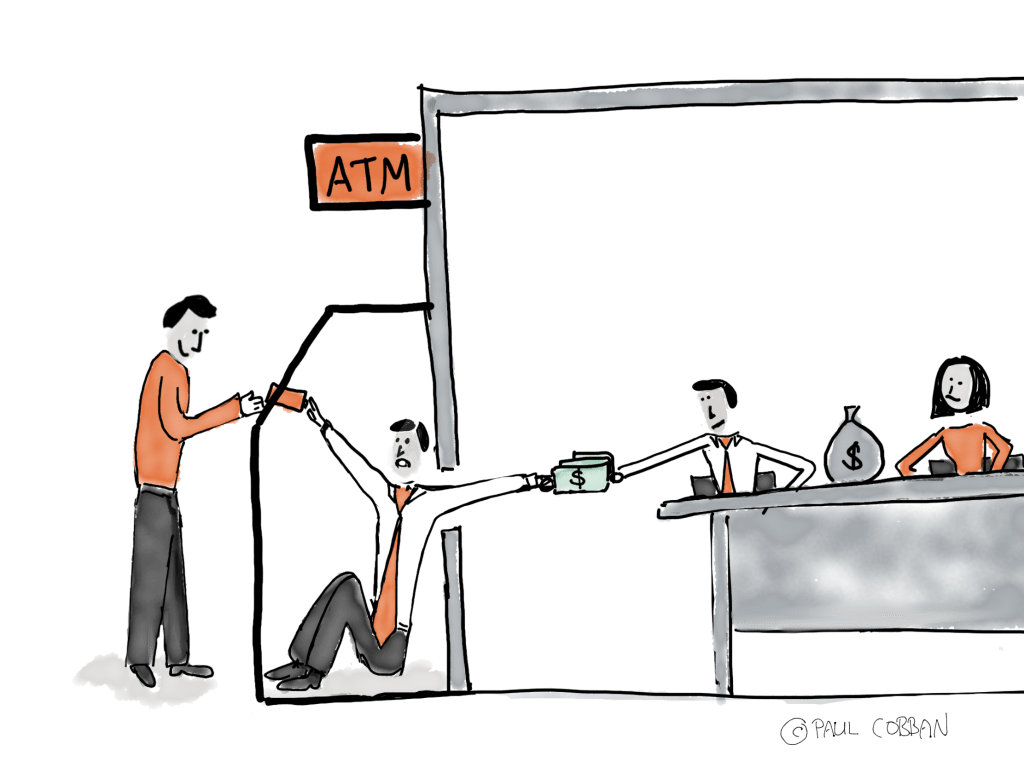

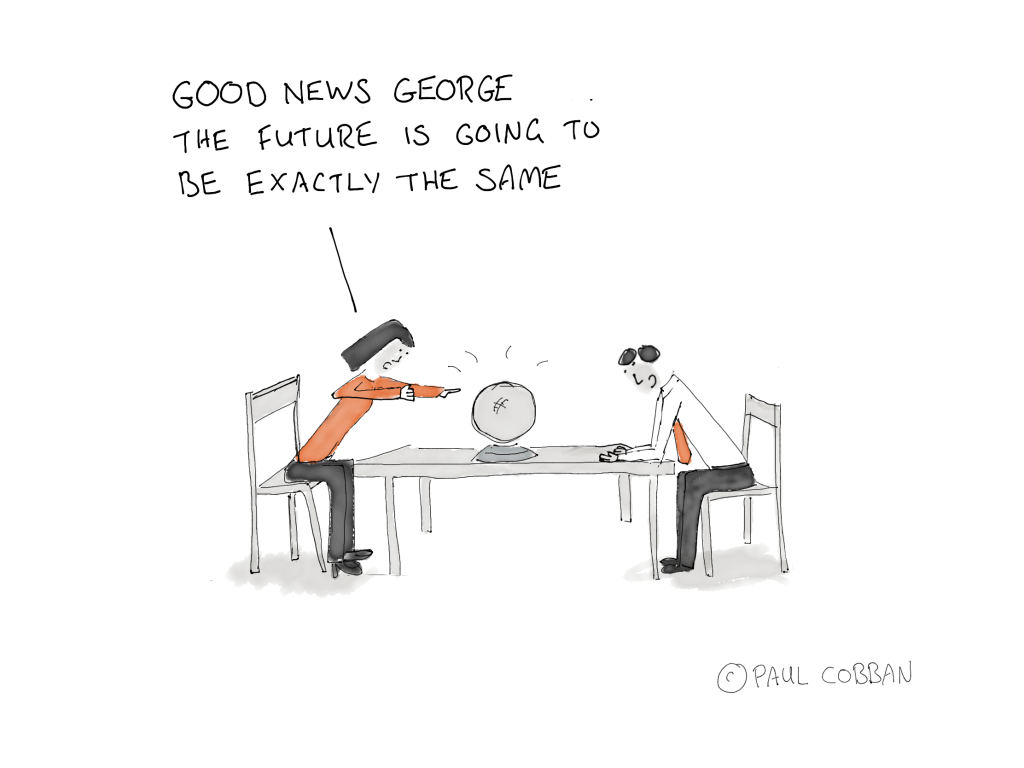

In 2017 at DBS we had huge digital transformation aspirations. We had stopped comparing ourselves to our traditional competition and started to use the big tech companies as a benchmark. Our internal mantra was to put the D in GANDALF, where GANDALF was an acronym made up from Google, Apple, Netflix, DBS, Amazon LinkedIn and Facebook. But we had a hit a roadblock. The silo between our business teams and tech teams was creating a blame culture. Whenever there was a systems issue the business team finger pointed to the tech team. The CIO would get a stream of escalation emails. The IT team complained that they did not have enough budget to cover stability, security and end of life investments while the business teams accused the tech teams of sandbagging budget to fulfil their own agenda. The relationship between the two departments was not conducive to achieving our digital ambition. So we approached some our friends in a couple of the GANDALF companies and asked how they dealt with the silo between tech and business. They all looked at us as though we were stupid. They told us “Tech is business and the business is tech”. There is no silo. But you do need leaders who can span both disciplines.”

This was a lightbulb moment for us. We realised we needed to fuse out business and tech teams together. We looked at how tech companies were organised. We studied the Spotify model that had been embraced by fellow financial companies like ING. Eventually we landed on something that we called a Platform Operating Model (POM).

- We grouped our applications, associated talent and budget into logical groups aligned to business, support and enterprise functions.

- We appointed joint leadership – one from tech and one from the business. This “2 in a box” structure was a proxy for ambidextrous leadership

- Each platform had a joint (across business and tech) strategy, budget and KPIs

We took 6 months to design the details and implement. But when we implemented the new model in early 2018, the finger pointing between business and tech stopped literally overnight.

There was immediate recognition that in a digital business keeping the systems up and running is a business responsibility not something that can be mentally outsourced to the tech leader. At business reviews our CEO started to ask business leaders to explain the tech elements of the joint strategy and the tech leader the business components. Platforms were given a single performance rating at the end of the year.

Other challenges remained and took time to tune and resolve. But this single change to the operating model had put us on track to become a GANDALF company.

Leadership Lessons

If your tech and business teams are at odds you will never become a digital company

Develop ambidextrous talent but you may have to develop intermediate steps such as 2 on a box to get there.

Address corporate process such as budgets and performance management to reinforce alignment between the IT and business functions

If you enjoyed this post please subscribe here for to get my weekly musings direct to your inbox